Table of Content

KYC, or ‘know your customer,’ is a mandatory verification procedure by financial institutions to minimize illegal activities. Since 2004, the Reserve Bank of India has prohibited individuals from opening a bank account, trading account, or demat account without fulfilling the KYC procedure for KYC. For any kind of financial transaction, you need to go through the KYC process. Once the KYC verification process is done, you must give the financial institution conducting the test information about your identity, address, and financial history. This can aid the bank in knowing that the money you chose to invest was not for any illegal activities.

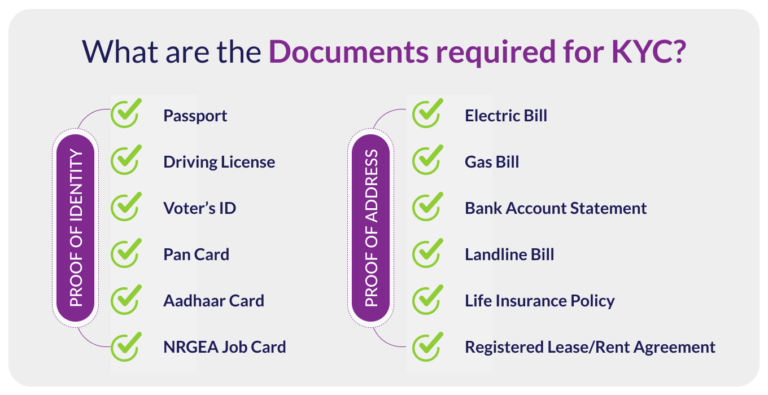

So, what are the documents required for KYC? Find out all about it below.

Documents form an essential component of the Know Your Customer (KYC) cycle as the latter validates an individual’s or business’s identity and address. All they are, in essence, is a way of proving that the person opening a bank account, taking out a loan or investing in a financial product is who they say they are.

Financial institutions in India are required to adhere to KYC norms, which are set up by the Reserve Bank of India for combating issues of fraud and money laundering. The banks and financial service providers obtain documents such as Aadhaar, PAN card, passport, or utility bills to ensure that their services are not misused.

Moreover, proper KYC identity proof documents help build a secure and transparent financial system. It enables organisations to evaluate customer risk, keep quality records, and provide personalized services more confidently. Without the documents being verified, the risk of identity theft, false claims, and illegal activities rises exponentially.

Submitting KYC requirements for mutual funds and other investments is not just a legal formality. They are an essential tool to protect financial institutions and their customers from harm.

The required documents for KYC need to be submitted as hard or scanned copies, depending upon the type of KYC. Two broad sets of documents are required for KYC: proof of identity and proof of address, which can overlap but generally vary. The documents required are as follows:

There are two types of KYC verification processes. They both are equal in terms of their authenticity and it is a matter of convenience whether one chooses to opt for one type over the other.

e-KYC is online verification conducted via the internet. It is effective for people who prefer to do the process via smartphones, tablets, computers, etc. It is good for people who are old, frail, bedridden, handicapped, and unable to move and go to particular places. For e-KYC, applicants must upload scanned copies of their identity and address documents or undergo verification through a video call (Video KYC), where they present their documents for verification.

On the other hand, in-person KYC verification is carried out offline. To do so, you can visit a KYC kiosk or mutual fund house and authenticate your identity using Aadhar biometrics. You can also call the KYC registration agency to send an executive to your home or office to carry out this verification.

You can submit KYC documents for verification through online as well as offline methods:

Understanding what documents are required for KYC can make the verification process a lot easier and convenient. Submitting them is a regulatory requirement. But it is also what makes your financial transactions more trustworthy and transparent.

According to KYC guidelines, you need to provide verification documents such as identity proof, address proof, and a photograph. Acceptable forms include ID cards from the government, utility bills, and bank statements. PAN and Aadhaar for KYC are very important. Banks may also have their own requirements, in addition to the normative regulations.

PAN cards are mandatory as KYC documents, especially in India, as the card is a major means of identification for tax. The financial institutions may ask for it to comply with many regulations.

Aadhaar card is deemed as one of the most authentic KYC documents in India. It acts as identity and address proof for KYC verification.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016

ARN NO : 47791 (AMFI Registered Mutual Fund Distributor)

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.