7 Jul 2025 , 12:02 PM

It was a mixed week for Indian indices. While the largecap NIFTY 50 fell, midcaps extended their gains. Financials were the key drag on NIFTY as all the heavyweight private sector banks declined. Negative FII flows and profit booking after the recent strong gains were the likely reasons behind the correction. Improving sentiment related to Indo-US trade deals led to selective buying among sectors. NIFTY PHARMA index was the best performer. Also, IT stocks rebounded. On the other hand, NIFTY REALTY index was the worst performer as it continued to witness profit booking after the strong rally in the first week of June when RBI had announced the jumbo rate cut.

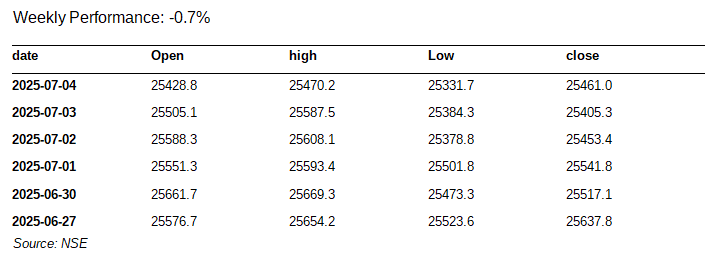

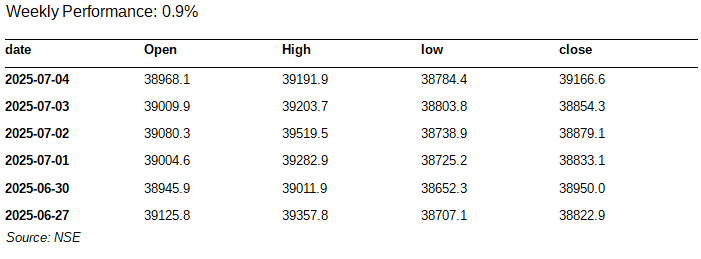

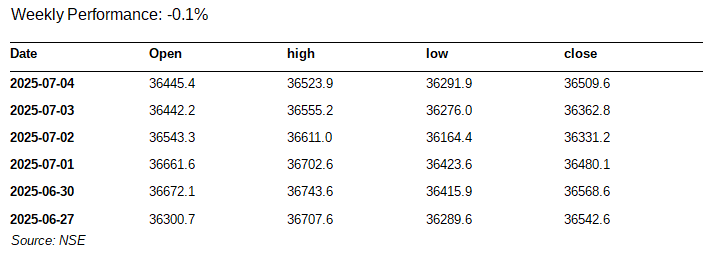

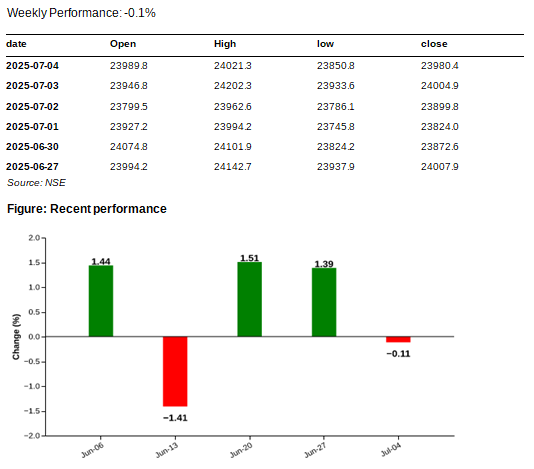

NIFTY 50 – Profit booking after two weeks of strong gains

Figure: Recent performance

At the close of the week, NIFTY 50 recorded marginal fall at 0.69%; giving up some of last week’s gain. Among the components of the Nifty index, BPCL (up 4.0%), Apollo Hospitals (up 3.5%), Infosys (up 2.4 %), Reliance Industries (up 0.8 %) and Bharat Electronics (up 3.1 %) were the top contributors. On the other hand, private sector banks – HDFC Bank, Axis Bank, ICICI Bank and Kotak Bank were the key drags, with each of them falling 1-4%. Trent was the top loser as the stock fell heavily after management’s underwhelming outlook during an analyst meet.

Last week witnessed broadbased profit-booking after two consecutive weeks of strong gains for the NIFTY. Market breadth was skewed toward declines and FII flows had also turned negative.

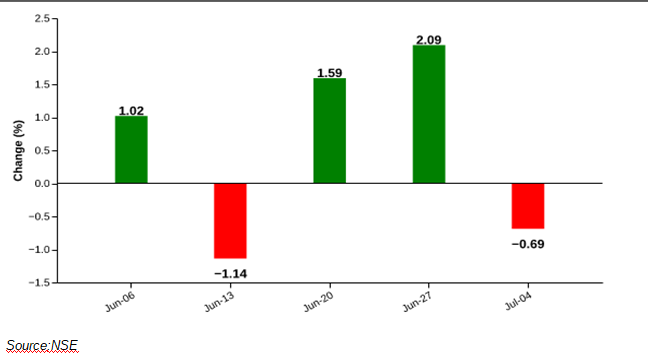

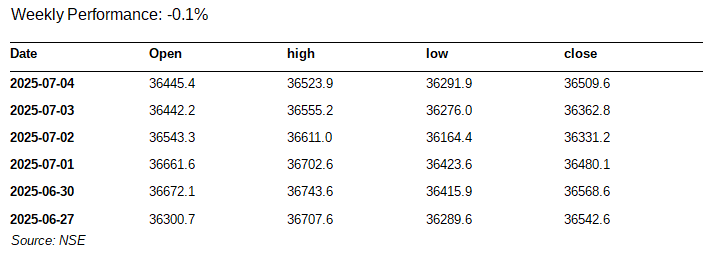

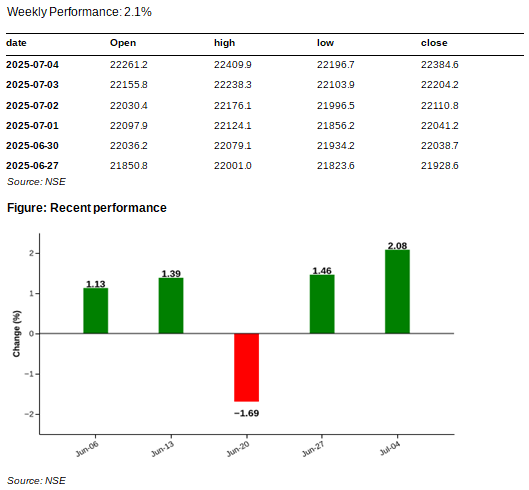

NIFTY MIDCAP SELECT – Outperforms large caps

Figure: Recent performance

The NIFTY MIDCAP SELECT closed strong and in the green for last week. Unlike the large cap NIFTY which witnessed profit booking, midcaps found strong support and closed up 0.57%. Top performers gainers of the index were IDFC First Bank, Dixon Technologies, and Aurobindo Pharma that surged 7.6%, 5.0 %, and 6.3%, respectively. On the flip side, Indian Hotels, Persistent Systems and HDFC Asset Management Company were among the losers, down by 2.6%, 1.9% and 2.2% respectively. Market breadth was significantly positive as 19 stocks advanced and only 6 declined.

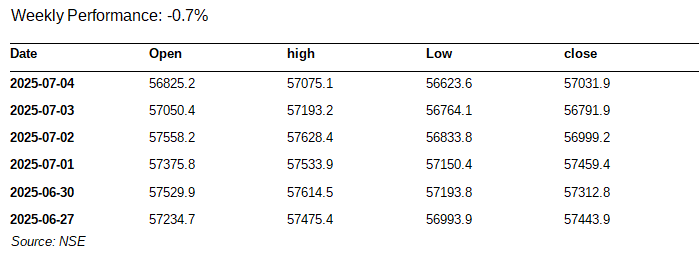

NIFTY IT – Rebounds to register a robust gain.

Figure: Recent performance

The NIFTY IT index closed 0.9% higher for the week supported by heavyweights. Infosys, Wipro and Coforge were the top performers, rising 2.03%, 1.89% and 2.69%, respectively. These were partially offset by losses in Tata Consultancy Services, Tech Mahindra and Persistent Systems, the top laggards. Market breadth was slightly positive as 6 stocks advanced while 4 declined.

After closing in the red in the prior week, NIFTY IT recovered and close in the green. A rally in global tech indices and positive newsflow about tarrifs has likely assisted NIFTY IT to close in the green.

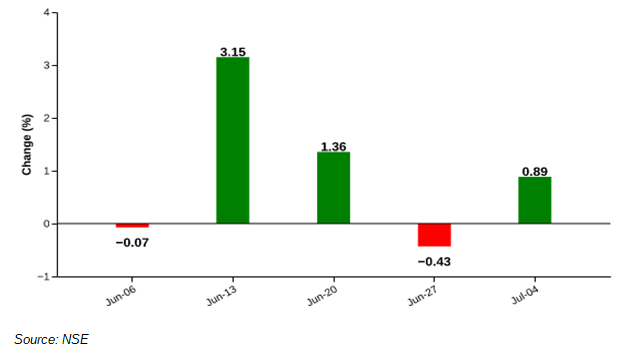

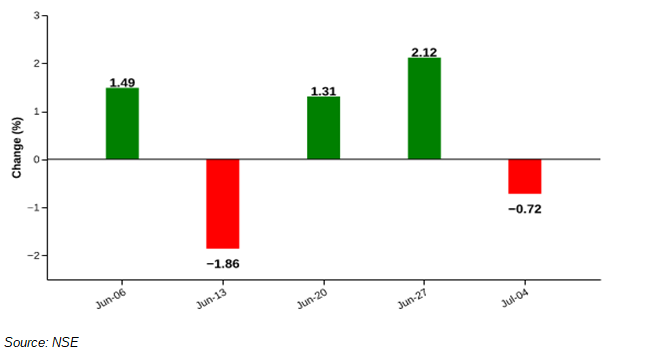

NIFTY BANK – Sees profit booking after two weeks of strong gains

Figure: Recent performance

Nifty Bank NIFTY BANK index finished the week with a loss of 0.72%. Heavyweights – HDFC Bank, Kotak Mahindra Bank and ICICI Bank – were the major losers, shedding 1.27 %, 3.54 %, and 1.33 %, respectively. Also, market breadth was neutral with a 0.5x Advance Decline Ratio. On the other hand select banks witnessed gains. IDFC First Bank, Federal Bank and Punjab National Bank were the top gainers, up 7.63, 3.33 and 4.24 %, respectively.

NIFTY ENERGY – OPTIMISM BUT WITH CAUTION GIVEN VOLATILITY

Figure: Recent performance

The NIFTY ENERGY index ended the week with a marginal fall of 0.09%. Top gainers were Siemens, ONGC, Reliance, IGL, and BPCL, that contributed to an overall gain 0.49% to the index. Conversely, Coal India, Suzlon, Power Grid, ABB and ATGL were the top losers, down up to 3%, pulling the index down by nearly 0.58%. While heavyweights like Reliance and ONGC were up for the week, a weak market breadth (23 of the 40 stocks were down) pulled the overall index down.

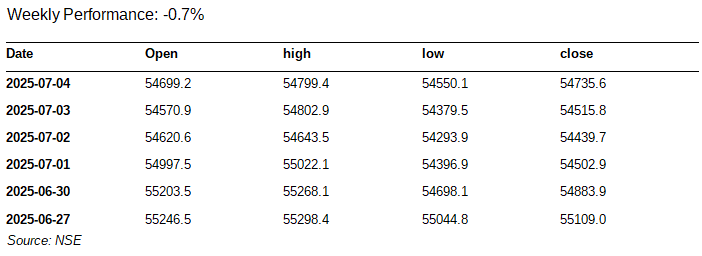

NIFTY FMCG – Gives up last week’s gains and remains flat for ~ 3 weeks

Figure: Recent performance

NIFTY FMCG index lost ended the week down 0.68%. Heavyweights – ITC (down 1.46%), Nestle (down 2.68%), Hindustan Unilever, (down 1.40 %) and Colgate-Palmolive (up 2.83 %) capped the gains. Among other top gainers in the index were Godrej Consumer, that gained 1.40%; and Dabur, that rose 1.80%.

Market breadth was moderately weak as 9 stocks had dropped in the 16 stock index. In the recent weeks, the index has witnessed considerable volatility with alternating periods of gains and losses; indicating lack of strong structural themes.

NIFTY AUTO – Pullback Amidst Mixed Cues

Source: NSE

The NIFTY AUTO index decreased marginally 0.11% for the week ending 2025-07-04 and ended at a level slightly lower than the previous week. Bosch, Balkrishna Industries, and Apollo Tyres were the best performers moving up by 11.38%, 5.85% and 2.31%, respectively. On the other hand, heavyweight stocks – M&M and TVS Motor was down 1 to 2%. ADR was also favorable with only 6 of the 15 stocks falling. However, these six contributed to more than 50% of the index weight. In conclusion, there was selective profit booking after two weeks of strong gains.

NIFTY PHARMA – Extends Gains

NIFTY PHARMA index closed positive at end of the week with a gain of 2.1% with strong rallies across many stocks and significant stock specific movements. The top contributors of the index were Divi’s Laboratories (up 5.52 %) Laurus Labs (up 10.6 %) Aurobindo Pharma (up 6.3 %) Glenmark Pharmaceuticals (up 7.0 %) and Natco Pharma (up 12.9 %). Many of these stocks gained on expectations of a Indo-US trade deal. On the other hand, JB Chemicals witnessed selling pressure after Torrent’s open offer at a discount. Overall, the momentum was positive as 15 of the 20 stocks had advanced.

The index has gained in 4 of the past 5 weeks. Optimism around Indo-US trade deal and stock specific events have been the key reasons behind the strong rally.

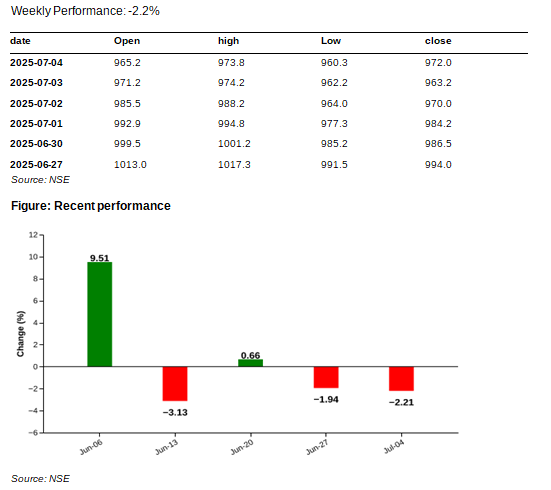

NIFTY REALTY – Witnesses another week of selling pressure

Once again, real estate stocks lost heavily as NIFTY REALTY index fell by 2.2%. Market breadth was negative as 3 shares gained, while 7 shares lost out of the 10 in the index. This is an indication that the selling was widespread. Only Raymond, Sobha and Mahindra Lifespaces gained, indicating extremely selective buying. Raymond’s gain was mostly due to investors positioning for the post-split prices. The index has fallen heavily in three of the past 4 weeks. Since witnessing a strong rally in early June due to RBI’s jumbo rate cut, the index has fallen almost continuously every week and has given up much of its 9.5% gain it witnessed in that week.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016

ARN NO : 47791 (AMFI Registered Mutual Fund Distributor)

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.