NIFTY fell for the third week in a row as heavyweight sectors – Financials and IT – continued to see profit booking. Lackluster earnings from Axis bank and TCS (the week before) set the tone for the losses in these sectors as both of them witnessed consecutive declines. On the contrary, the midcap index rallied as it recovered strongly from the losses in the week before.

Sectorally, while most indices witnessed gains, IT and Financial fell. While IT sector continued to see a broadbased weakness, the losses in banks were mostly limited to the private sector players while PSU banks gained. This likely indicates sector rotation out of these key sectors as investors book profits. On the other hand, Realty topped the best performing sector list as nearly all of the stocks witnessed strong gains. Auto and Pharma also recovered strongly after losses in the prior week. Finally, FMCG sector continued to see strong interest as it rallied for the second consecutive week.

NIFTY 50 – A poor start to earnings season

Weekly Performance: -0.7%

| date | open | high | low | close |

| 2025-07-18 | 25108.6 | 25144.6 | 24918.7 | 24968.4 |

| 2025-07-17 | 25230.8 | 25238.3 | 25101.0 | 25111.4 |

| 2025-07-16 | 25196.6 | 25255.3 | 25121.1 | 25212.1 |

| 2025-07-15 | 25089.5 | 25245.2 | 25088.4 | 25195.8 |

| 2025-07-14 | 25149.5 | 25151.1 | 25001.9 | 25082.3 |

| 2025-07-11 | 25255.5 | 25322.4 | 25129.0 | 25149.8 |

Source: NSE

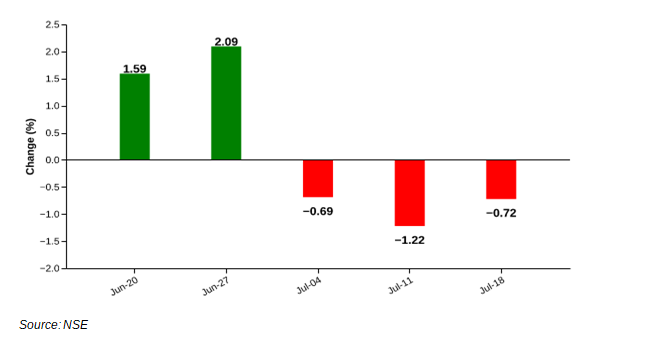

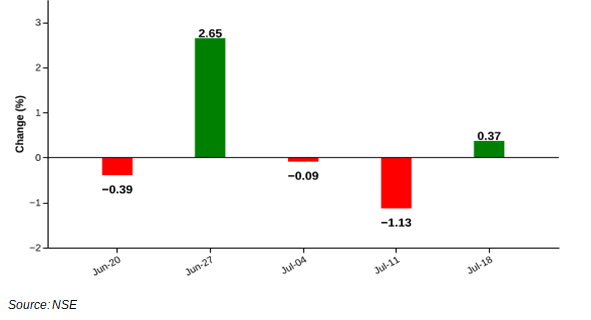

Figure: Recent performance

Nifty 50 closed the week lower by 0.72%, registering a third consecutive week of losses. Banking sector was among the top detractors. The sector sold off after lackluster results from Axis. Banking Heavyweights – Axis Bank, HDFC Bank and Kotak Mahindra Bank were among the top losers. Most of the IT stocks also closed in the red. Kotak Mahindra Bank and HCL Technologies were among the key detractors. On the other hand, M&M, Hero Motors ITC, Wipro and Bajaj Auto contributed positively. Market breadth was mixed with an advance/decline ratio of 0.5.

Reviewing its performance over the past five weeks, the NIFTY 50 index has been trending downwards after the sharp rally in June. It has witnessed losses in each week in July.

NIFTY MIDCAP SELECT – Recovers some of last week’s losses

Weekly Performance: 1.1%

| date | open | high | low | close |

| 2025-07-18 | 13277.6 | 13283.3 | 13121.2 | 13171.0 |

| 2025-07-17 | 13369.5 | 13369.9 | 13246.2 | 13264.8 |

| 2025-07-16 | 13375.8 | 13380.7 | 13304.0 | 13323.3 |

| 2025-07-15 | 13205.3 | 13357.9 | 13175.0 | 13342.0 |

| 2025-07-14 | 13072.2 | 13187.8 | 13011.6 | 13169.0 |

| 2025-07-11 | 13190.0 | 13204.4 | 12995.0 | 13026.8 |

Source: NSE

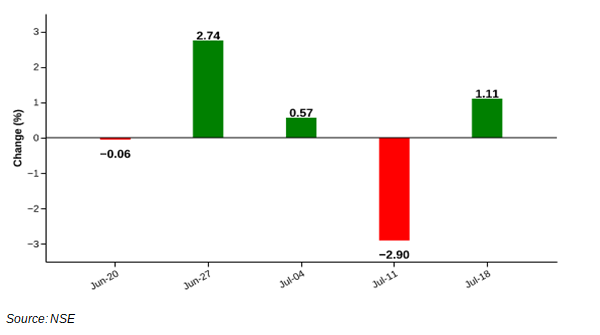

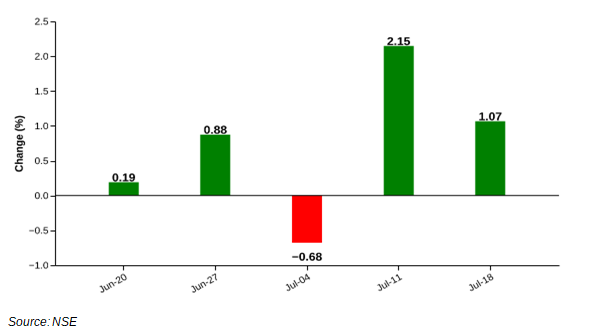

Figure: Recent performance

The NIFTY MIDCAP SELECT index rose by 1.11% for the week ended July 19, 2025, as they rallied sharply to recover some of the losses from its earlier week. Leading the charge were HDFC AMC, Indian Hotels, Godrej Properties, Idea and Federal Bank that added 1.03% to the index. In the losers pack, IDFC First Bank, AU Small Finance Bank, Hindustan Petroleum Corporation, Persistent Systems and Coforge were the prominent losers, declining in the range of 0.43%.

An analysis of the past weeks indicates that the midcap index has been volatile. While it gained in 3 of the past 4 weeks, it witnessed significant movements in two of them (more than 2.5%). After under-performing the large cap NIFTY index in the first half of the year, the index has outperformed the NIFTY in the past week.

NIFTY IT – Profit booking continues

Weekly Performance: -1.5%

| date | open | high | low | close |

| 2025-07-18 | 37366.7 | 37419.6 | 36951.9 | 37141.9 |

| 2025-07-17 | 37552.9 | 37666.6 | 37060.7 | 37138.6 |

| 2025-07-16 | 37325.7 | 37758.5 | 37258.1 | 37660.7 |

| 2025-07-15 | 37077.0 | 37664.9 | 37048.9 | 37424.6 |

| 2025-07-14 | 37643.4 | 37664.2 | 37016.1 | 37273.7 |

| 2025-07-11 | 37702.6 | 37990.8 | 37558.1 | 37693.2 |

Source: NSE

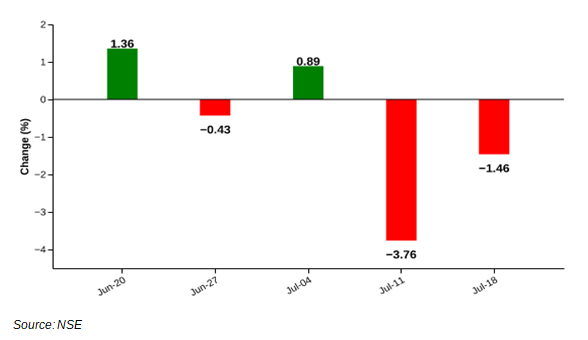

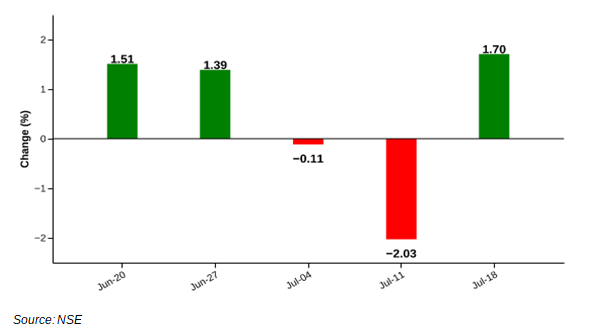

Figure: Recent performance

NIFTY IT index lost 1.46% in the last week. The sector has witnessed profit booking since TCS lacklustre results. It continued last week. The only exception was Wipro, which gained 3.4% on stronger earnings. HCL Technologies cracked 5.46%, Tata Consultancy Services lost another 2.3% and Tech Mahindra fell 3.3%.

9 of the 10 stocks fell – indicating an extremely bearish market breadth. Since TCS results, investors have booked profits in IT heavyweights. While Wipro’s results offered a positive flavor, it was still insufficient to offset the overall weakness in the space.

NIFTY BANK – Weakness Persists

Weekly Performance: -0.8%

| date | open | high | low | close |

| 2025-07-18 | 56524.2 | 56705.1 | 56204.9 | 56283.0 |

| 2025-07-17 | 57231.9 | 57262.9 | 56780.1 | 56828.8 |

| 2025-07-16 | 57111.2 | 57276.6 | 56937.6 | 57168.9 |

| 2025-07-15 | 56709.2 | 57134.9 | 56707.8 | 57006.6 |

| 2025-07-14 | 56780.8 | 56896.3 | 56594.2 | 56765.4 |

| 2025-07-11 | 56843.4 | 57091.1 | 56607.8 | 56754.7 |

Source: NSE

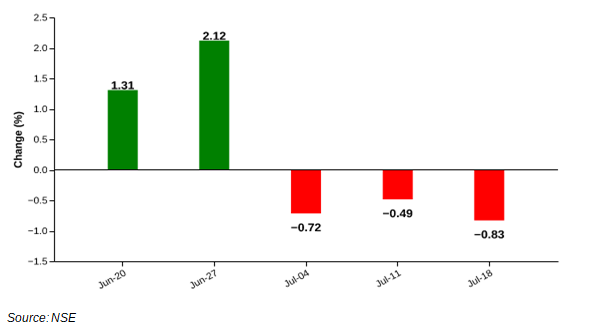

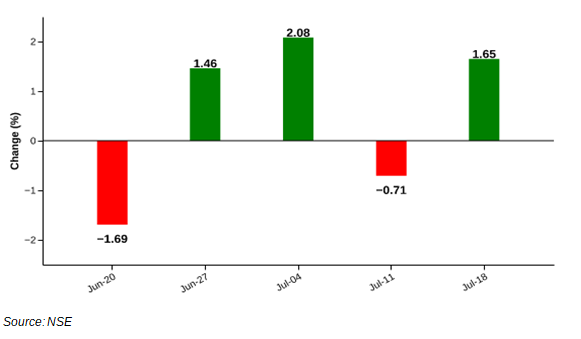

Figure: Recent performance

The NIFTY BANK index closed the week down by 0.83% and declined for the 3rd consecutive week. The index was cushioned by gains in State Bank of India, Bank of Baroda, Federal Bank and Punjab National Bank with contributions of 2-3%. Conversely, the top losers on the index were Axis Bank, HDFC Bank, Kotak Mahindra Bank, IDFC First Bank and AU Small Finance Bank with Axis Bank’ 6.35% fall being the worst performer.

Poor earnings from Axis Bank set the negative tone for the sector. After a lackluster set of results where NIMs disappointed the street, Axis witnessed analyst downgrades. While the market breadth was positive due to gains in PSU banks, the sharp falls in private sector heavyweights took the index down.

NIFTY ENERGY – Outperforms in a volatile market

Weekly Performance: 0.4%

| date | open | high | low | close |

| 2025-07-18 | 36502.1 | 36590.0 | 36144.0 | 36231.6 |

| 2025-07-17 | 36426.9 | 36537.9 | 36330.1 | 36438.2 |

| 2025-07-16 | 36297.9 | 36388.6 | 36199.8 | 36350.9 |

| 2025-07-15 | 36237.9 | 36431.6 | 36180.5 | 36308.5 |

| 2025-07-14 | 36159.8 | 36289.7 | 36035.1 | 36201.1 |

| 2025-07-11 | 36432.1 | 36488.6 | 36039.7 | 36097.9 |

Source: NSE

Figure: Recent performance

The NIFTY ENERGY index ended up 0.37% for the week ending 2025-07-19 as the sector had a a mixed bag of performances. ONGC, Coal India and Thermax pulled up the index with gains of 3.5% to 12.2%. Thermax (+12.2%) rallied the most on the back of good earnings. The gains were trimmed as losses in Reliance Industries, BHEL, Power Grid Corporation and Suzlon Energy leaned on the index. The market breadth was also positive with an advance-decline ratio of 0.55; with 22 advances with 18 declines.

A quick analysis of the performance over the last five weeks suggests that the index has been volatile with it gaining in 2 of the past 5 weeks.

NIFTY FMCG – Another Strong Week

Weekly Performance: 1.1%

| date | open | high | low | close |

| 2025-07-18 | 56943.4 | 56943.4 | 56388.2 | 56506.9 |

| 2025-07-17 | 56751.2 | 57017.1 | 56665.4 | 56843.1 |

| 2025-07-16 | 56452.9 | 56791.5 | 56286.1 | 56685.6 |

| 2025-07-15 | 56170.6 | 56465.8 | 56033.4 | 56429.1 |

| 2025-07-14 | 55903.7 | 56080.6 | 55743.0 | 56025.6 |

| 2025-07-11 | 56023.4 | 56349.9 | 55792.4 | 55910.2 |

Source: NSE

Figure: Recent performance

India and Tata Consumer Products were the top gainers on the index, up between 0.7% and 7.2%, with ITC Hotels and Varun Beverages leading the charge. Conversely, Hindustan Unilever, Godrej Consumer Products and Dabur were the top losers, down by 1.2%.

A quick recap of recent performance shows that the performance FMCG index has improved significantly in the recent past. While positive pre-quarter commentary set the tone, the index has continued to benefit from sector rotation trades. The market breadth for last week was also positive with 11 of the index stocks in the green.

NIFTY AUTO – A significant rebound

Weekly Performance: 1.7%

| date | open | high | low | close |

| 2025-07-18 | 24050.4 | 24182.2 | 23874.2 | 23894.3 |

| 2025-07-17 | 24003.2 | 24157.0 | 23954.0 | 24002.5 |

| 2025-07-16 | 23910.1 | 24041.2 | 23654.1 | 24011.2 |

| 2025-07-15 | 23588.8 | 23951.8 | 23576.1 | 23905.2 |

| 2025-07-14 | 23518.5 | 23598.2 | 23447.8 | 23552.0 |

| 2025-07-11 | 23866.8 | 23894.4 | 23433.3 | 23493.8 |

Source: NSE

Figure: Recent performance

The NIFTY AUTO was the among the top sectoral gainer of the week, up 1.70% on the back of robust gains in auto majors like M&M, Hero MotoCorp and Bosch. While Bosch was the top gainer at 4.7%, M&M was the top contributor with +1 percentage point to the index. In addition to the strong gains, positive market breadth (with only 6 declines), added to the index performance.

On the other hand, the gains were tempered by weakness in stocks such as Maruti Suzuki, Tata Motors and Apollo Tyres – losing 1.23%, 0.23%, and 0.75%, respectively. Auto has notched decent weekly performance in the recent past. It notched significant gains in 3 of the past 5 weeks and only 1 week of material decline.

Nifty Pharma – Recovers from profit-booking

Weekly Performance: 1.7%

| date | open | high | low | close |

| 2025-07-18 | 22713.6 | 22720.3 | 22511.7 | 22592.8 |

| 2025-07-17 | 22647.6 | 22794.2 | 22625.8 | 22680.3 |

| 2025-07-16 | 22678.6 | 22694.8 | 22562.2 | 22593.9 |

| 2025-07-15 | 22513.5 | 22688.7 | 22373.8 | 22665.7 |

| 2025-07-14 | 22166.5 | 22502.3 | 22118.7 | 22410.3 |

| 2025-07-11 | 22172.9 | 22346.8 | 22124.8 | 22225.9 |

Source: NSE

Figure: Recent performance

NIFTY PHARMA index was up 1.65% for the week ending 2025-07-19. The rally was broadbased with an advance-decline ratio of 0.80. 16 shares advanced while only 4 declined. The leaders of the rally (by contribution) were Sun Pharmaceutical Industries, Torrent Pharmaceuticals, Alkem Laboratories, Laurus Labs, and Biocon which added over 80% of the gains on the index. Natco and Gland Pharma were the top gainers and were up 7% each.

On the other hand, Divi’s Laboratories, Cipla, Abbott India and Zydus Lifesciences were the top laggards, with Divi’s Laboratories leading the selloff.

A recap of the performance of NIFTY PHARMA over the last 5 weeks indicates strong rallies in 3 of the weeks while the remaining weeks witnessed profit booking. Both the rallies as well as declines have been strong with an average weekly gain of 1.7% during the ‘gain weeks’ and an average weekly loss of 1.2% in the ‘loss weeks’.

NIFTY REALTY – Strong Weekly Rebound

Weekly Performance: 3.8%

| date | open | high | low | close |

| 2025-07-18 | 1005.5 | 1007.7 | 995.2 | 999.9 |

| 2025-07-17 | 994.2 | 1005.0 | 990.6 | 1001.1 |

| 2025-07-16 | 986.0 | 992.9 | 982.9 | 988.8 |

| 2025-07-15 | 979.7 | 990.8 | 975.5 | 984.0 |

| 2025-07-14 | 965.0 | 977.7 | 961.7 | 976.2 |

| 2025-07-11 | 974.2 | 975.7 | 961.5 | 962.9 |

Source: NSE

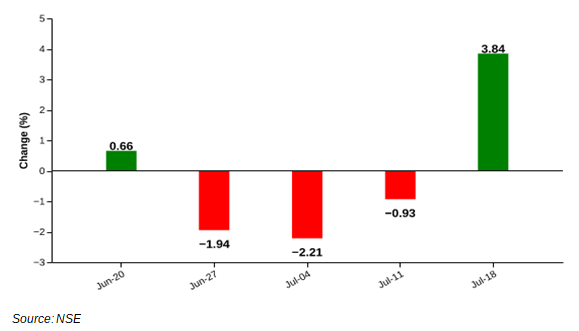

Figure: Recent performance

NIFTY REALTY was up 3.84% for the week ended Friday, 19 July, 2025. The rally was broadbased as nearly all the stocks advanced and the declines in 2 stocks were mild. This rally was led by strong gains in Godrej Properties, DLF, Prestige Estates, Lodha Developers and Brigade Enterprises, which were the top contributors to the index. In addition, recently listed, Sobha rallied strongly and was up 13% fo the week. Godrej Properties was up 7.21% while Prestige Estates advanced 5.14%. On the flip side, Phoenix Mills corrected mildly.

The performance over the last five weeks indicates that the index gain in the last week was preceded by 3 consecutive weeks of significant profit booking.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016

ARN NO : 47791 (AMFI Registered Mutual Fund Distributor)

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.